Should We Increase Prices for Next Year?

PriceBeam

·

3 minute read

PriceBeam

·

3 minute read

More companies than not increased prices in the past 12 months, reasons ranging from increases in input material costs to a general expectation that it was now easier as competitors raised their prices, and often the "market" (read: the customers) expected it due to high inflation. If not now, then never, seemed to be the sentiment.

Inflation still remains high. Some forecasts predict it will start to go down in the next six months, though others predict that we will still have to live with higher-than-normal inflation for quite a while yet, despite that increased interest rates in many countries is helping to reduce inflation.

Some vendors have also faced criticism from either trade partners, such as retailers, or final consumers in the case of consumer goods, when implementing price increases. Some retailers in both Europe and North America have chosen to take price negotiations to the press, making examples out those vendors that the retailers deemed to push for excessive price increases.

The question that many companies ask themselves now is whether to plan another price increase for the coming 12 months? On one hand, inflationary pressure is still there, on the other hand customers are pushing back harder than at the last round of price increases. The threat of also being portrayed as "profiteers" or "exploiters" in the eye of consumers is making many revenue growth manager think twice.

Insights, Insights, and more Insights, rather than Guesswork

88% of all prices are set using guesswork, or other sub optimal approaches such as "let's just add some percent to current prices". However, in a situation where one doesn't know if a price increase is the right strategy, such guesswork can be killers.

The starting point is to understand the willingness-to-pay for individual products, per customer segment:

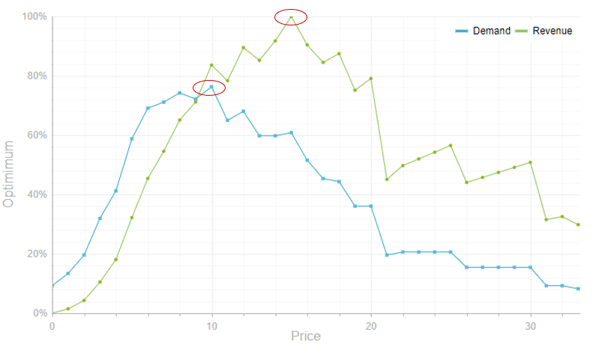

In the simplified example above, we plot different price points on the horizontal axis, and then using PriceBeam Comparative Willingness-to-Pay studies we have plotted a demand curve and a revenue curve. Where the demand curve peaks, this is the price with the highest volume, and where the revenue curve peaks this is the price with the highest revenue.

The above shows the optimal price for one product, which of course can be compared against the current price, and then assessed whether to take a price increase or not.

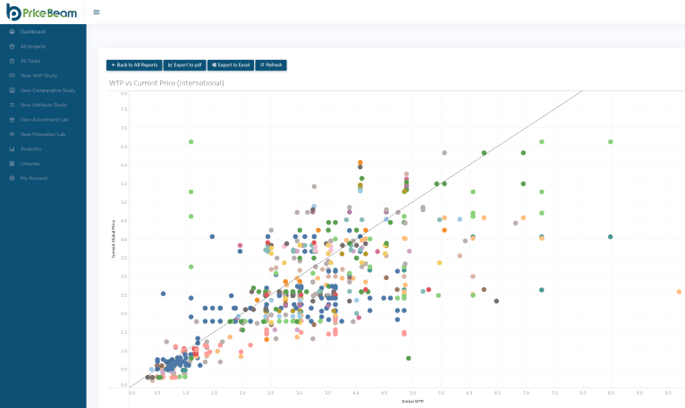

The same approach can be taken across a portfolio of products:

In this example each dot represents a product in a given market. The colours denote different product categories or different countries. On the horizontal axis we plot the willingness-to-pay peak for each product, and on the vertical axis the current price. Two distinct groups of products they occur:

- Price Increase Surpluses: when the WtP is higher than the current price, covered by all dots to the lower right of the straight line, then there is, all other things equal, an opportunity to increase prices as consumers are actually willing to pay more for those products.

- Price Increase Deficits: when current price is higher than WtP, then consumers have an issue with the product's value. These are the dots to the top left of the straight line. For these products a price increase may have detrimental effects.

In-depth insights into willingness-to-pay can help creating a more elaborate price increase plan.

Make a Granular Price Increase Plan

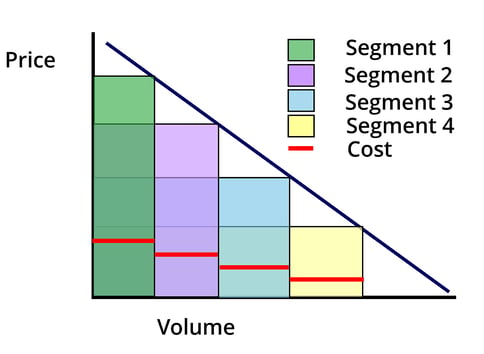

One size fits all rarely applies in business, even less to in a professional pricing environment. In fact, willingness-to-pay varies by factors of 2-5 in most markets, i.e. the difference between those customers willing to pay the least (but still buy) and those willing to pay the most (and buy) varies 200-500%. This is why a differentiated pricing strategy overall makes sense.

The same applies across countries: it is extremely common to see levels of willingness-to-pay being 3 to 6 times higher in one market than another, essentially for the same product.

Put simply: with big differences in willingness-to-pay, price increases must be planned by countries, customer segment, brand, product group, and individual products. Anything else leads to sub-optimal pricing.

Price Increase Tactics

Price increases have many aspects to them, including:

- Diagnostics and Insights

- Sizing the price increase

- Features & Benefits

- Competitors

- Brand and business impact

- Internal communication

- External communication

- Sales team

- Tactical mechanics

- International aspects

Check out our extensive list of tips and tricks here: https://blog.pricebeam.com/ultimate-list-of-ideas-for-successfully-implementing-price-increases

Also, join our webinar on the topic of increasing prices: https://info.pricebeam.com/webinar-should-we-increase-prices-for-next-year

If you are considering increasing prices and could use some more insights, quickly and cost-effectively, then PriceBeam has the solution for you. Get in touch with our team here.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)