Create Transaction Utility and Increase Willingness-To-Pay

PriceBeam

·

2 minute read

PriceBeam

·

2 minute read

Transaction utility is a term coined by world-renowned behavioral economist Richard Thaler, based on a series of experiments he conducted with relation to creating utility via transaction design, and how this can be used to charge higher prices without losing out on sales. While the term was originally used to describe a few select biases, it is now used as a general term to describe value-adding (or subtracting) features that are not directly related to the product or service. Let's look at an example of how transaction design can change consumers' value perception:

Imagine 2 scenarios:

You're eager to watch your country's football team play in the World Cup Finals, but the tickets are outside your reach at $50. Now, imagine 2 scenarios:

1. One day you participate in an online survey and you're lucky enough to win a ticket. In the middle of your celebration, a stranger calls you up, offering to buy your ticket for $400. Do you take the money and miss the game?

2. As it turns out, you didn't win anything from participating in that online survey. However, your neighbor did and now he's offering to sell his ticket to you for $400. Do you pay the money and go to the game?

It's all a bit hypothetical, but Thaler actually managed to gather a lot of empirical evidence suggesting that in Scenario 1, the person would keep the money; that is, forego $400 to keep his ticket; while in Scenario 2, he would not be willing to pay $400 for the ticket.

In other words, the transaction design in Scenario 1 creates a higher value perception than that of Scenario 2, despite the product being exactly the same.

This is an example of the endowment bias, where consumers attach much greater value to items that they feel a sense of ownership of. Other biases include the Status Quo bias and anchoring bias.

Thaler found several other examples, all of which you can read through here.

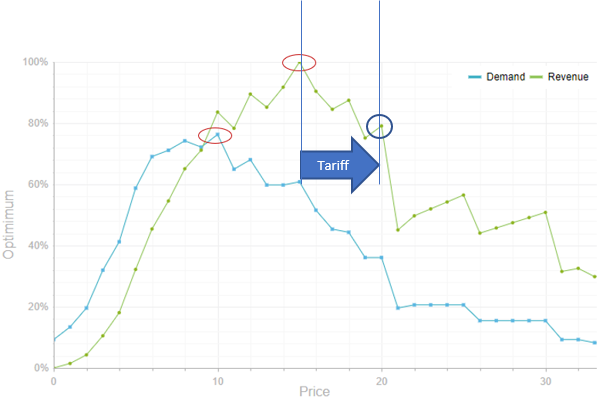

Using Transaction Utility Theory in Pricing

There are several examples of certain cognitive biases that make consumers behave irrationally. This provides a great opportunities for reaping in additional profits: it all comes down to creating the right context for the purchase so that the value perception is maximized. Here, behavioral experiments such as the ones conducted by Thaler can provide valuable insight into your customer's imperfections, and show how you can boost willingness-to-pay among your customer segment by taking these biases into account. Maybe you can benefit from increasing your retail price and use more discounts? Or have your customers subscribe to a free trial that will automatically be renewed at its end, hereby utilizing the status quo bias?

See how PriceBeam in a demo with one of our experts.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)