Price Discrimination: A Powerful Bottom-Line Enhancer

PriceBeam

·

3 minute read

PriceBeam

·

3 minute read

Price discrimination is the practice of selling products at different prices, depending on the customer's willingness to pay. Using microeconomic terms, the aim with price discrimination is for the firm to extract as much consumer surplus as possible, and turn it into producer surplus instead: i.e. the firm gets more, the consumer gets less. As with so many other microeconomic concepts, the simplification of real-life behavior can sometimes come across as rather tough: most CEOs don't actually go to work every morning aiming to squeeze every drop out of his loyal customers -- rather, most firms actually do try to make mutually beneficial economic transaction, because that's how you stay in business in the real world where consumers don't always exhibit perfectly rational, utility-maximizing behavior.

That being said, some customers are, indeed, willing to pay more than others, and it is in the firm's interest to price accordingly, both for profit-maximization, customer acquisition, and customer retention. In general, we work with three types of price discrimination, that is, first-degree price discrimination, second-degree price discrimination and third-degree price discrimination.

First-Degree Price Discrimination

First-degree price discrimination is also known as perfect price discrimination, and is the practice of charging every individual customer exactly the price that he or she is willing to pay.

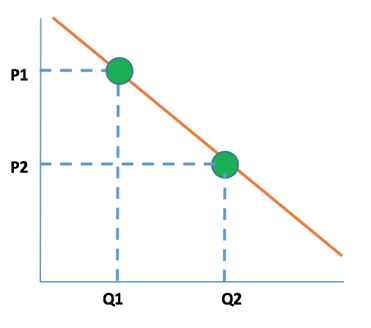

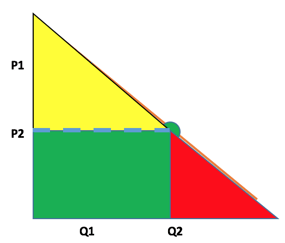

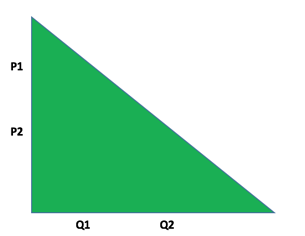

As illustrated above, customers willing to pay P1 will pay P1: customers willing to pay P2 will pay P2. Pricing is individualized rather than fixed, and in that way, the firm is capturing all profit, while not turning any customers away either. On the contrary, imagine if the firm charged a fixed price that was P2: all customers with a higher willingness to pay (i.e. on the left on the X-axis) would have the firm leave money on the table, while the one's with a lower willingness to pay would not buy. Consequently, the yellow area in the left figure represents the foregone profit that firms lose out on because some customers are charged too low a price, while the red area represents the lost sales due to price-sensitive customers being charged too high a price. The green area in the figure of the left represents the profit that remains. Of course, as illustrated in the figure on the right, the green area (i.e. the profit) is much greater as no profit nor sales are foregone.

While price discrimination is desirable for the firm in theory, it is impossible to obtain this in reality. Customers do not go around advertising their exact willingness to pay, and moreover, legal conventions make it difficult for firms to carry out. However, as firms' data analytics and price management algorithms become increasingly sophisticated, more and more firms are moving towards it: that is, some using some variation of personalized pricing and accounting for some differences in willingness to pay in their price setting.

Second-Degree Price Discrimination

Second-degree price discrimination involves charging different prices for different quantities, i.e. quantity discounts. This idea builds on the concept of diminishing marginal utility where the first unit is worth more than the 10th: e.g. one pizza is enough to make you feel full, then you won't pay as much for a second pizza - if anything.

This strategy is much more feasible as the firm doesn't need to know anything about the customer, nor about his or her willingness to pay. The customer will simply adjust the quantity to his or her individual preferences, and the firm can extract consumer surplus. For instance, a tele-company can sell a basic bundle with 200 minutes, 500 texts, and 1GB data; and then allow that additional minutes, texts, and data can be purchased. The price-sensitive customer will stick with this bundle, while a customer with a high willingness to pay will purchase additional minutes, texts and data. Moreover, this is commonly seen with electricity, water, and generally quantity discounts in supermarkets.

Third-Degree Price Discrimination

Third-degree price discrimination is a very commonly used practice by today's firms, and simply involves charging different prices to different customer segments. While getting an individual to reveal his exact willingness to pay is pretty much impossible, it is much easier to have him reveal which customer segment he belongs to, and thus, the firm will have a rough idea where his willingness to pay lies. For instance, airlines charge business travellers a high price because they know they have a high income, and often, the journey is paid for by the employer, not the traveller. While airlines can, of course, charge different prices for business class and economy class, they also change prices based on other factors such as time of day and destiniation, based on what they know about business travellers' habits and preferences. So, for example, if they know that most domestic morning flights to New York City are frequented by business travellers, the price will be set accordingly; while domestic flights in the weekend may be frequented by college students visiting family, who will use an alternative form of transportation if the price is too high.

While this will not allow the firm to capture consumer surplus similar to that of first-degree price discrimination, this type is much more feasible - and it is rapidly evolving. Big data, highly granular analytics etc., allow firms to detect patterns in the behavior exhibited by different types of consumers, and both online and offline retailers are experimenting - some with great success - with applying highly personalized pricing, and sophisticated algorithms for identifying which customer segment a person belongs to.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)