2025 in Pricing: Willingness-to-Pay Went Mainstream, Tariffs Mattered Again, and Testing Beat Guesswork

PriceBeam

·

3 minute read

PriceBeam

·

3 minute read

Introduction

Looking across our 2025 posts, several themes stood out. Pricing decisions moved closer to the customer with forward signals that show how people value products by market, by channel, and by moment. Those signals shaped everything from tariff pass through plans to sustainability premiums to how teams design portfolio structures that customers find intuitive. Here is a concise recap of the year’s most visited themes and how to carry the momentum into 2026.

Willingness-to-Pay Became a Working Signal

Multiple 2025 articles showed practical ways to make Willingness-to-Pay (WtP) a working input instead of a one-off study. A compact pricing power index helps decide when to move, when to hold, and when to invest. Paired with a light refresh cadence, WtP also protects credibility because shopper thresholds can shift with claims, formats, and macro turns. If you want a fast on ramp, start with a WtP read on core and premium in one priority market and use the result to set price endings and tier gaps by channel.

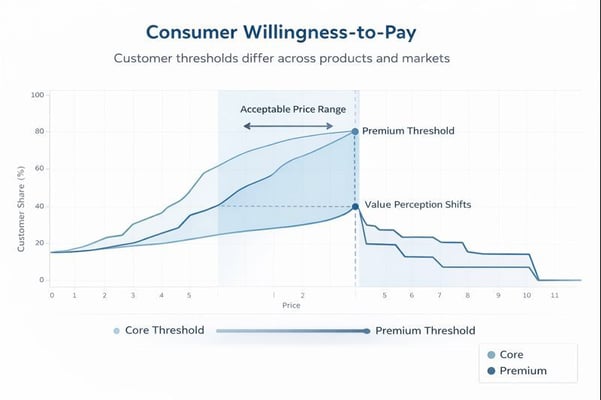

Example illustration of Willingness-to-Pay curves showing how consumer price thresholds differ across product tiers or markets, and why Pricing Power must be measured, tracked, and refreshed over time.

Testing Beat Guesswork

A second thread in 2025 was replacing opinion led changes with simulation. When history is a poor guide, virtual shoppers let teams test price and promotion choices before making them, compare multiple routes, and avoid training deal only behavior through accidental calendar design. The approach works best for new formats, channels where AB tests are impractical, and moments when competitive or policy shocks break yesterday’s relationships. Decide with evidence first and execute with confidence.

Tariffs Moved from Headlines to Calendar Planning

Tariff policy changes continued across several large markets. The working pattern is to treat tariffs as a sequence of effective dates rather than a single cliff. During pass-through, price endings and tier gaps matter and private label anchors need to be visible in the plan. Phased scenarios help fit timing windows, avoid threshold cliffs, and keep the retailer narrative focused on category outcomes.

.png?width=800&height=400&name=Tariffs%20%20(2).png)

In planning for 2026, the most effective teams are aligning pass-through timing with their price tier structure and stress-testing likely competitor and private label responses so sales can negotiate with confidence.

Sustainability Acted Like a Value Signal

A third theme was practical guidance on sustainability premiums. A premium can be earned when the claim is specific, relevant to the mission, and visible in the product or format. Vague labels rarely move value perception, while clear claims paired with formats that reduce waste or improve convenience can work.

What Changed Inside Pricing Teams

Three operating shifts showed up again and again across project work and conversations.

- From ladders to portfolio structures. Teams designed price tier structures that make sense to shoppers. Fewer near duplicates, cleaner tier gaps, and endings that feel familiar by channel.

- Assortment rationalization became surgical. Simulation supported decisions, preserved trade-up, and anchored retailer conversations in category outcomes.

- Research and history worked together. Research guards against surprises. History anchors execution in reality. The best plans use both in parallel.

Key Takeaways to Carry into 2026

- Use WtP as a working input. Keep a simple pricing power index and refresh WtP lightly when markets move so thresholds remain current.

- Translate roles into price tiers. Write down tier gaps and the endings you will defend by channel and use them to steer changes through 2026.

- Simulate before you execute. Test two price or promotion routes with virtual shoppers and compare results side by side.

- Treat tariffs as rolling dates. Align pass-through with tier gaps and check private label anchors in every scenario.

- Measure structure health. Track a Tier Integrity Index and a short overlap view so you can fix duplication and protect trade up.

Three Considerations to Kick-off 2026 Strong

If the ideas above were not applied in 2025, consider the following as you plan Q1.

1. One focused WtP refresh in a priority market.Reason: a current read on shopper thresholds prevents missteps when list or promo moves are under discussion.

☑️ Action: core and premium SKUs only, then update endings and tier gaps.

2. A portfolio and assortment checkpoint.Reason: overlap accumulates during the year.

☑️ Action: run a quick overlap and incrementality scan and simulate a simplified lineup before the next reset window.

3. A promotion calendar review.Reason: repeated deep cuts can flatten tier structure and raise promo reliance.

☑️ Action: test two alternative calendars and retire mechanics that collapse tiers.

Highlights From 2025 to Re-visit

Staying on Top of Consumer Willingness-to-Pay: Pricing Power Tracking

https://blog.pricebeam.com/staying-on-top-of-consumer-willingness-to-pay-pricing-power-tracking

Willingness-to-Pay Drift: The Hidden Risk in Your Pricing Strategy

https://blog.pricebeam.com/willingness-to-pay-drift-the-hidden-risk-in-your-pricing-strategy

Stop Guessing, Start Testing with Test-Driven Price Optimization (TDPO)

https://blog.pricebeam.com/test-driven-price-optimization

What Tariffs Mean for Your Pricing in a Tariff-Driven Economy

https://blog.pricebeam.com/what-tariffs-mean-for-your-pricing-in-a-tariff-driven-economy

The Benefits of Optimizing Prices, Assortment, and Promotions Simultaneously

https://blog.pricebeam.com/benefits-of-optimizing-prices-assortment-and-promotions-simultaneously

Further Reading and Tools

If you want to go deeper on any of the topics above, explore these resources and try them on a live category.

Predictive Research including WtP and Comparative WtP for clean guardrails

https://www.pricebeam.com/predictive-research

https://www.pricebeam.com/comparative-willingness-to-pay

Assortment Optimization and Promotion Optimization for simulation before you execute

https://www.pricebeam.com/assortment-optimization

https://www.pricebeam.com/promotion-optimization

RGM Optimizer and Simulator for side by side plan comparison

https://www.pricebeam.com/rgm-optimizer-simulator

Pricing Power Snapshot and Tracker for a single signal that guides timing

https://www.pricebeam.com/pricing-power-snapshot

https://www.pricebeam.com/pricing-power-tracker

We look forward to sharing more practical pricing and market research insights throughout 2026. If you would like to explore these ideas on your own data, you can request a short demo or start a free trial, or contact us to discuss a focused study for your market.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)